UK Players Taxes On Gambling Winnings - Full Guide

When you consider starting gambling, a good question to always ask is if there are any taxes you need to pay.

You may want to play at British best online casinos or even at foreign brands that operate in the UK. Either the case, this information is valuable, and our gambling experts are breaking it down for you in this article.

Keep reading to find out everything you need to know about taxes and the entire legal environment of online gambling in the United Kingdom!

What taxes do British gamblers have to pay?

All winnings resulted from gambling activities are entirely tax-free in the United Kingdom. This is true for both online casino gaming and winnings from gambling halls.

Players in England, Wales, Scotland, and Northern Ireland can play slot machines, Blackjack, Poker, Roulette, and any other gambling games without worrying about paying any taxes and walking out with all their winnings. Funds obtained from lotteries and sports betting are also tax-free.

Do professional players pay tax in the UK?

Professional gamblers do not have to pay any tax on their winnings during competitions, regardless of the game they play. This means that not only casual players can enjoy their hobby, but professional players can truly make the most out of this.

Which funds are subjected to fees?

If you are a professional player, you have to keep in mind that other gambling-related funds obtained during official competitions may be taxable. These may be in the form of tournament appearance fees, for example.

Another situation that may not happen often is if you receive free seats at a tournament, they might be considered a form of payment. In this case, winnings you obtain from these seats have very high chances of being considered an extension of the payment.

Luckily for you, this ambiguous situation does not apply to most players

Even if your winnings are not taxed when you receive them, the amount may be subject to certain taxes when it enters your bank account.

For example

If you decide to gift someone a part of your winnings, the Gift Tax may apply, and if the money becomes part of your estate, you will have to pay Inheritance Tax. In addition, if you gain interest from these winnings, they are subject to Income Tax.

What professional gamblers should pay attention to

As a professional casino player, you may not have to worry about paying taxes on your winnings, there are other things you need to keep in mind:

- You have to pay National Insurance, file tax returns every January, and keep your gambling records, if you only rely on the income resulted from gambling competitions.

- You are not legally obliged to pay National Insurance if you are self-employed. However, not doing this will affect your state pension when you retire.

- If you do not have another job, you have to be Class 2 and Class 4 National Insurance as a self-employed worker, and you can pay both of these when you submit your tax return.

Be aware

Keeping track of your gambling records is highly important if you gamble professionally.

Why would past financial records help you?

Because suddenly having huge money deposits into your accounts may attract attention from the authorities. It is helpful to have your records as a way to prove the origins of the money and show that you are not engaging in any illegal activity.

By doing this, you also are able to budget better, so even if you are never in a situation in which you have to prove anything to the authorities, it is still a helpful thing to do.

How much UK casino operators are taxed

In 2020-2021, the United Kingdom government raked nearly 2.8 billion pounds in betting and gambling tax receipts.

But if players do not pay any tax on their winnings, who does?

The only other party involved, which is the casino operator.

The duties they have to pay:

- 15% of net stake receipts from fixed odds bets, bets on betting exchanges, and totalisator wagers on dog or horse races;

- 3% of net stake receipts for financial spread bets;

- 10% of net stake receipts for all other spread bets;

- 15% of operator’s profits that come from wagers not on fixed odds and not on horse or dog racing – pool betting duty;

- 12% of the price paid or payable on a ticket or chance in a lottery – lottery duty;

- 5% of net takings from machine games with a maximum cost to play up to 0.20 GBP and cash prize up to 10 GBP;

- 20% of net takings from machine games with a cost to play of up to 0.21 GBP and a maximum prize of 11 GBP;

- 25% of net takings from machine games with a cost to play over 5 GBP;

- 15% of the gross gaming yield for the first 2,471,000 GBP;

- 20% gross gaming yield for the next 1,703,500 GBP;

- 30% of gross gaming yield for the next 2,983,000 GBP;

- 40% of gross gaming yield for the next 6,296,500 GBP;

- 50% of the remainder gaming yield;

- 21% from gross gaming revenues on all transactions with UK customers – remote gaming duty.

Offshore gambling taxes

When you play casino games on offshore websites, the law and taxes from that country apply.

We only present you with fully regulated gaming sites and advise you always to choose legit and safe platforms.

Any online casino that operates from any country other than the United Kingdom can apply for and obtain a United Kingdom Gambling Commission license. Once granted, this allows all British players to play and not pay any duties on their winnings.

How about casinos regulated by other authorities?

Not all online casinos that UK players can access are licensed and regulated by this strict and trustworthy authority. Some operate under different licenses, case in which taxes will be deducted from your winnings according to the law in that jurisdiction.

These foreign operators pay general betting duty, pool betting duty, and remote gaming duty of 15%.

Unlicensed casinos

Even more, some online gambling platforms available to British players are not licensed and regulated at all.

When you play at this type of casino, you are not protected by any authority. This means you also may have to pay duties from your winnings.

Recommendation

Generally, it is not a good idea to play on such online platforms, as you have no guarantee that your money and personal information will be safe.

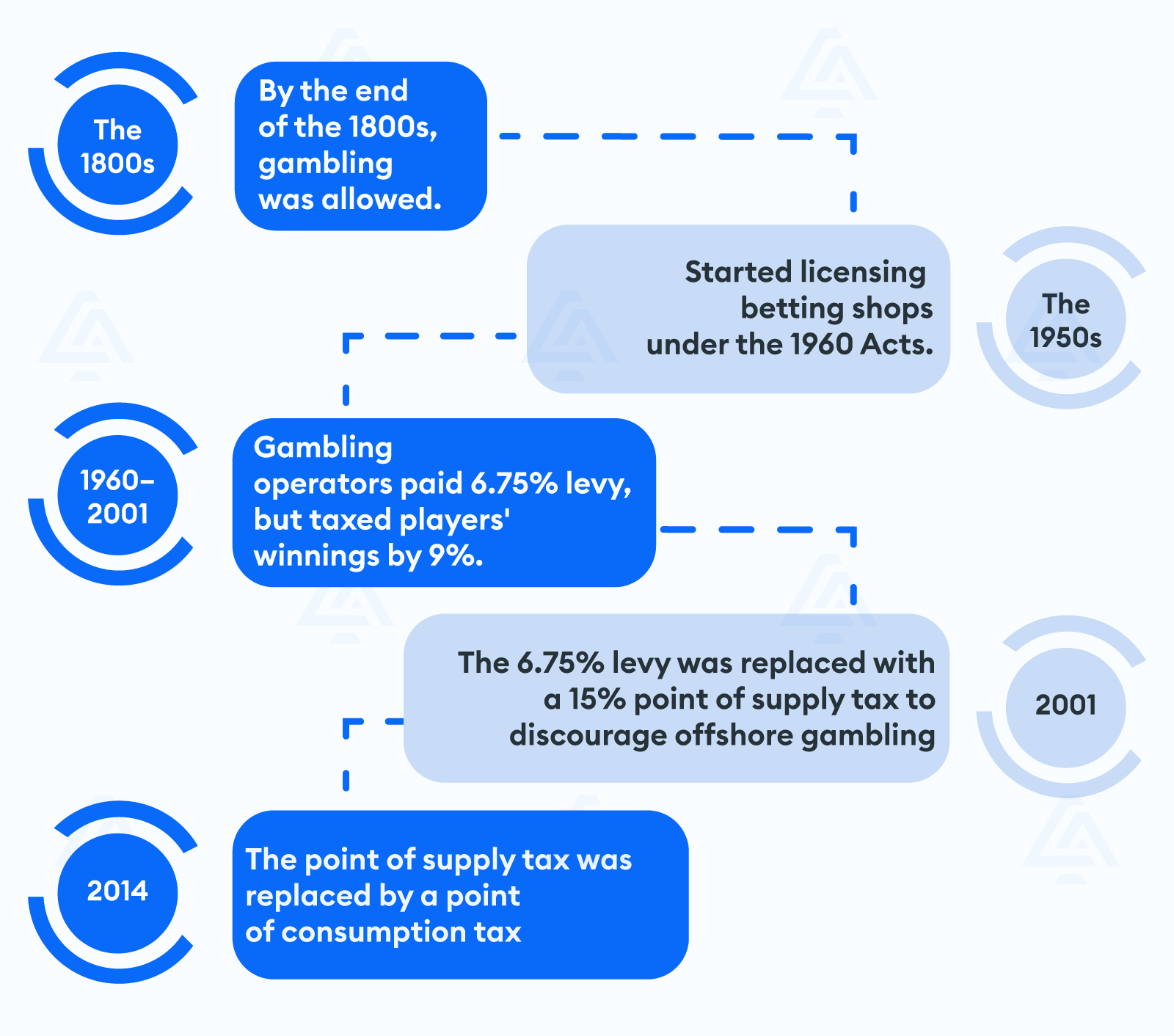

Brief history of UK gambling laws

Casino gamers in the United Kingdom did not always have the luxury of not paying duties on the funds obtained.

Victorian period

Victorians were facing a real problem with unlicensed gambling, which led them to issue the Gaming Act of 1845, which deemed contracts between gamblers and casino operators invalid. By the end of the 1800s, gambling was allowed.

However, it was only legal from the Totalisator Board, ran by the government at specific courses and tracks. All profits were sent back to the Treasury.

The 1950s

With time, exceptions to this rule started to appear, such as Football Pools. This quickly gained popularity, and it was classed as a low wager competition, so it was allowed.

Towards the end of the 1950s, black-market betting was flourishing, and the government’s efforts failed to stop it. That is when it started licensing betting shops under the 1960 Acts.

1960 – 2001

From 1961 to 2001, all gambling operators had to pay a 6.75% levy, and they had the option to pay it from the stake or the winnings.

They have chosen to tax players 9% on their winnings.

2001

In 2001, this levy was replaced by a 15% point of supply tax on their gross profit. This change was meant to discourage players from choosing offshore sites in order to benefit from lower or no taxes at all.

Their popularity was skyrocketing at that moment, which meant fewer players were betting on UK sites, so less money went to the government in the form of duties.

2014

In 2014, the point of supply tax was replaced by a point of consumption tax on all the operators’ gross profits through an amendment to the Gambling Act 2005.

Checking if a casino is legit and you don’t have to pay tax

Only online casinos licensed by the UKGC (United Kingdom Gambling Commission) allow you to cash out your winnings without paying any tax.

Therefore, you should only gamble on such websites. Aside from being exempt from any duties, you also benefit from a high level of safety and high-quality services.

How to tell if the site you chose is legit, and you will keep all your winnings:

-

Read our casino reviews

Our gambling experts write extensive casino reviews based on data and information gathered during research.

The presentation of the gaming site is done in an objective manner with the sole purpose of informing and educating players. Along with the honest analysis of every aspect the gaming platform comes with, we also check for its license and make sure it is a legit site.

We only present you with fully regulated casinos, so regardless of which one you prefer, they are all safe, and you do not have to pay any taxes on your winnings.

-

Check the bottom of the homepage for the authority badge

You might find a platform you like, and maybe we haven’t reviewed it yet. In this case, you have to obtain the information yourself. A quick way to tell if an online casino owns a license is by checking the homepage footer.

There, you should see multiple badges, among which you will find a licensor’s badge.

-

Verify the license number

In some rare cases, casinos keep on functioning even with an expired license.

That is why it is essential to verify the license number and make sure the site is still fully regulated, and the badge on the homepage footer is real.

Final advice

If you are a resident of the United Kingdom and play at a fully licensed and regulated online casino, you can get all your winnings without having to pay any duties!

The casino operators pay all taxes, and you can simply enjoy the fun without any worries. The gambling environment and legislation in the UK have changed a lot over the years, and now all British players can make the most out of their gaming sessions.

References

- Excise Duty – Gambling Duty rates

Adina Minculescu

Adina Minculescu Tudor Turiceanu

Tudor Turiceanu